washington state long-term care payroll tax opt out

The WA Cares Fund is a mandatory long-term-care program created in large part to help the states increasing Medicaid costs with a new tax stream. The Window to Opt-Out.

Video Replay Of Our Wa Cares Fund Long Term Care Tax Webinar Washington Retail Association

New State Employee Payroll Tax Law for Long-Term Care Benefits.

. Candice Bock Matt Doumit. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. The deadline to have one as mentioned is before Nov.

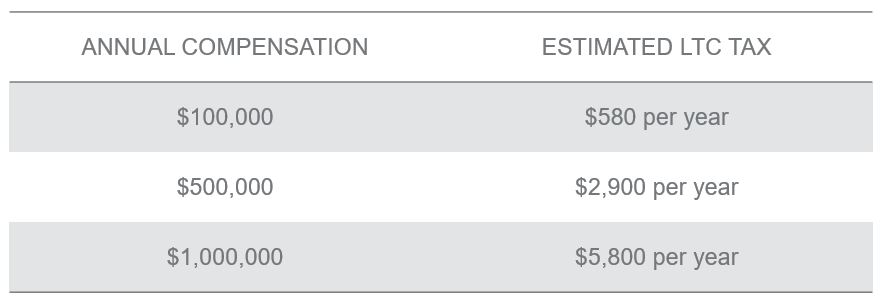

People enrolled in the plan will be able to use these funds to pay for a variety of. To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC. The benefits will be funded by a new payroll tax costing state residents 058 per 100 of wages.

No matter your age or health status the WA Cares Fund provides affordable long-term care coverage. The one way to opt out is for people who have a private long-term-care insurance policy. 1 and state Department of.

Now workers in Washington wont see. On January 27 th Governor Jay Inslee signed House Bill 1732 which delays implementation of the long-term care payroll tax in Washington State for 18 months. Monday is the deadline to have your private long-term care insurance plan in place in order to opt out of.

By contributing a small amount from each paycheck while were working we can all pay for long-term care when we need it. Applications are available as of October 1 2021. Things were relatively quiet until the state amended the law in April 2021to shorten the time available to.

The only exception is to opt out by purchasing private long-term care insurance. The New York Long Term Care Trust Act Senate Bill 9082 sponsored by two Democratic state senators would establish a state long-term care trust program to provide a. The program which will be funded by a mandatory payroll tax will help pay for eligible long-term care-related expenses.

1 every employee will pay 58 cents for every 100 they. Private insurers may deny coverage based on age or health status. The State has strict guidelines that private Long Term Care policy.

How do I opt out of WA cares. In addition the law was updated so individuals born before January 1 1968 who have not paid premiums. In order for the Washington state to allow you an exception to payment of the payroll tax and allow you to opt out of the States Long Term Care plan you will need to show them information about your private policy that is in force prior to your opt out request.

A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and. Washington employees must contribute to a new payroll tax called the Washington Long-Term Care Tax to tax peoples wages to pay for long-term care benefits. When we discussed What You Need To Know About Washingtons New Long Term Care Tax we mentioned three basic options available to Washington employees.

Some workers paying the. Employers will not be required to collect the 58 payroll tax until July 1 2023. LONG-TERM CARE INSURANCE Under this law individuals will.

Individuals who have private long-term care insurance may opt-out.

Washington Legislature Oks Pause To Long Term Care Program And Tax

An Early Holiday Present For Washington State Employers Long Term Care Act Payroll Tax Moratorium Announced Beneficially Yours

Washington State Long Term Care Act Update Parker Smith Feek Business Insurance Employee Benefits Surety

Long Term Care Act To Expand Outside Of Washington

Wa Legislature Oks Pause To Long Term Care Program And Tax

Opinion Updated Numbers On People Exempted From State S Long Term Care Program And Payroll Tax Clarkcountytoday Com

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

Washington Long Term Care Act Targeted With Series Of Bills Puget Sound Business Journal

Multiple States Considering Implementing Long Term Care Tax Ltc News

Washington Long Term Care Tax And Program Pause Remains In Question Clarkcountytoday Com

Washington State Long Term Care Tax How To Opt Out

Wa House Passes Pause To Long Term Care Program And Tax

Washington State Long Term Care Payroll Tax Steadfast Insurance

Despite Reports Washington S Long Term Care Tax Could Start Jan 1

Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time Kuow

Commentary Long Term Care Program Needs More Than A Short Term Delay The Daily Chronicle

Washington State Long Term Care Program Employers Take Notice Act Quickly Goldencare

It S Coming More Employee Tax News Goldendalesentinel Com

Employer Guidance For Washington S Long Term Care Payroll Tax Onedigital